Introduction

Investing in stocks can feel intimidating, especially if you’re new to the market. BMO Alto stock has gained attention from investors seeking long-term growth and steady returns. Whether you’re a beginner or an experienced trader, understanding the right approach to investing in BMO Alto stock is crucial.

Understanding BMO Alto Stock

Before investing, it’s essential to understand what BMO Alto represents. BMO Alto is a part of the Bank of Montreal’s investment offerings, focusing on growth and innovative financial solutions. Its stock performance is influenced by market trends, interest rates, and the company’s financial health. Monitoring these factors can provide insights into potential investment opportunities. Investors should examine historical performance, earnings reports, and industry trends. Knowing the stock’s volatility and risk profile is vital for setting realistic expectations.

Define Your Investment Goals

Start by identifying your financial goals. Are you seeking short-term gains or long-term growth? Defining clear objectives helps determine your strategy. Consider factors like risk tolerance, available capital, and investment horizon. A clear goal prevents impulsive decisions driven by market fluctuations. For example, if you aim for steady growth, you may prefer a long-term holding strategy rather than frequent trading. Align your goals with BMO Alto’s performance history and potential for returns.

Conduct Thorough Research

Research is the foundation of successful investing. Gather information about BMO Alto’s business model, revenue streams, and industry position. Examine financial statements, quarterly earnings, and market analysis reports. Understanding the company’s strengths, weaknesses, and competitive advantages can inform better investment decisions. Use reputable sources and avoid relying solely on tips from social media or forums. For structured guidance, you can follow an Invest In Bmo Tips resource to enhance your research strategy.

Choose the Right Brokerage Account

Investing in BMO Alto requires a brokerage account. Select a platform that aligns with your needs, offering low fees, a user-friendly interface, and reliable customer support. Consider factors like trading tools, research resources, and account security. Ensure the brokerage is regulated and transparent. Many investors prefer platforms that allow fractional shares, enabling investment with smaller amounts. Setting up the account correctly ensures smooth transactions when you decide to buy BMO Alto stock.

Decide on Investment Amount

Determine how much capital you are willing to invest. Avoid allocating funds you might need urgently. Diversifying investments across multiple assets can reduce risk and increase potential returns. It’s wise to invest an amount that aligns with your risk tolerance and financial situation. Calculating the proportion of your portfolio to allocate to BMO Alto can help maintain balance while taking advantage of growth opportunities.

Learn the Market Trends

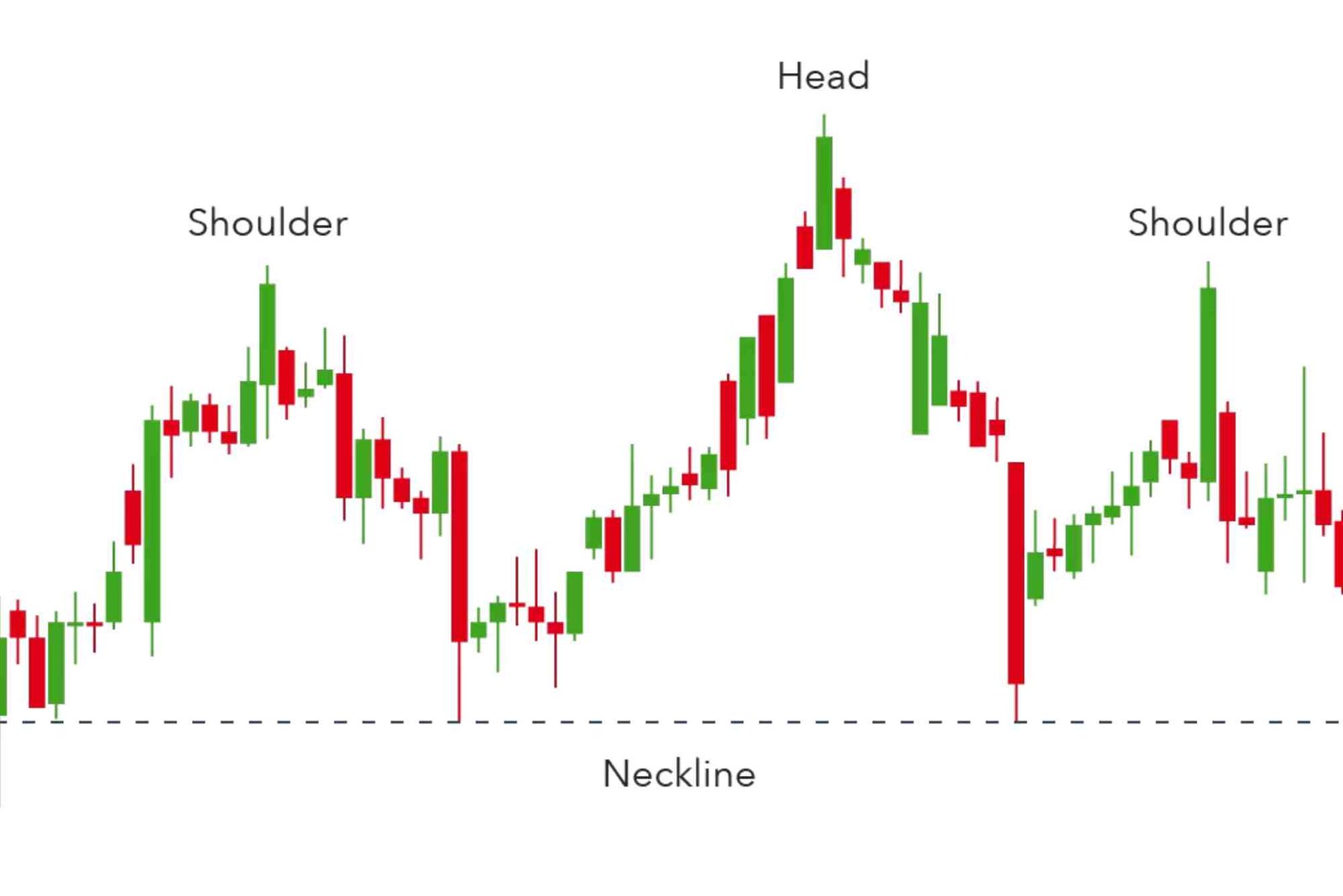

Understanding market trends helps you make informed decisions about when to buy or sell. Monitor stock charts, industry news, and economic indicators affecting BMO Alto. Market sentiment, global events, and sector performance influence stock prices. Use technical and fundamental analysis to identify entry points. Patience is key; avoid rushing into investments without assessing market conditions. Staying informed increases your confidence and reduces emotional decision-making.

Execute Your Purchase

Once prepared, execute your investment. Place a buy order through your brokerage account, specifying the number of shares and price limits. Decide between a market order for immediate execution or a limit order for price-specific entry. Confirm all transaction details before submission to avoid errors. Once purchased, the stock will reflect in your portfolio, and you can start tracking its performance.

Monitor and Adjust Portfolio

Investing is an ongoing process. Regularly review BMO Alto’s performance and market trends. Assess if your investment aligns with your initial goals and make adjustments if necessary. Rebalancing your portfolio ensures risk management and capitalizes on growth opportunities. Avoid making impulsive decisions based on short-term fluctuations. A disciplined approach helps maintain steady progress toward your financial objectives. Following an Invest In Bmo Alto Guide can provide structured insights on monitoring strategies and adjustment techniques.

Understand Risks and Mitigation

All investments carry risks, including BMO Alto stock. Price volatility, economic changes, and company-specific factors can affect returns. Mitigate risks by diversifying your portfolio, setting stop-loss orders, and keeping an emergency fund. Staying educated about market trends and avoiding emotional trading decisions minimizes potential losses. Risk awareness allows for more confident decision-making and strategic planning.

Consider Long-Term Strategy

Long-term investing often yields the best results. Holding BMO Alto stock for an extended period allows compounding benefits and reduces the impact of short-term volatility. Focus on the company’s fundamentals and growth potential rather than daily market fluctuations. Patience and consistency are key traits of successful investors. A long-term approach often aligns with retirement planning or wealth-building goals.

Stay Updated on Company News

Keep track of BMO Alto’s announcements, financial results, and industry developments. News can affect stock prices, either positively or negatively. Subscribe to newsletters, financial portals, and company reports to remain informed. Being proactive enables you to make timely decisions, whether it’s buying more shares during dips or selling during market highs. Staying updated ensures your investment strategy remains aligned with the latest information.

Take Action with Confidence

Investing in BMO Alto stock doesn’t have to be complicated. By defining goals, conducting research, choosing the right brokerage, and following a disciplined strategy, you can maximize your chances of success. Regular monitoring, risk management, and a long-term mindset will help you navigate the stock market effectively. Take the first step today and explore opportunities to grow your wealth by making informed investment choices. For detailed guidance, explore a Related article on theprimewriter.com to expand your knowledge and strategies.

FAQs

What is the best way to start investing in BMO Alto stock?

Begin by defining your goals, researching the stock, and selecting a reliable brokerage account. Small, informed investments reduce risk.

How much should I invest in BMO Alto?

Invest an amount that aligns with your risk tolerance and financial situation. Diversifying your portfolio reduces exposure to single-stock risks.

Is BMO Alto stock safe for beginners?

While no stock is completely risk-free, understanding market trends and adopting a long-term strategy can make BMO Alto a suitable option for beginners.

How often should I monitor my BMO Alto investment?

Regularly track performance and market news. Quarterly reviews are sufficient for long-term investors, while active traders may monitor daily.

Where can I find tips for investing in BMO Alto stock?

Reliable financial blogs, official company reports, and investment guides are great sources. For structured advice, check out Invest In Bmo Tips.